Umoja Wetu: A Journey Towards Economic Dignity Through Savings and Loans Groups

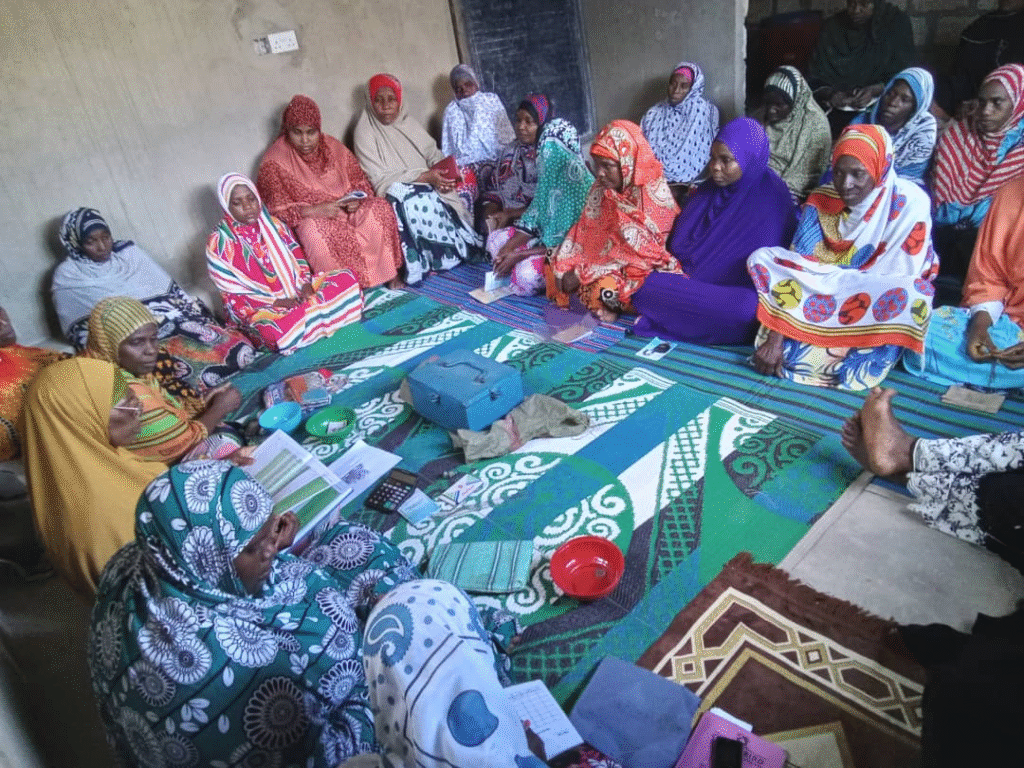

In the quiet neighbourhood of Msingini Shehia on Pemba Island, the Umoja Wetu group has emerged as a powerful example of resilience and positive transformation among persons with disabilities (PWDs). The group is made up of 30 members (22 women and 8 men) and is rooted in unity, discipline, and a shared commitment to achieving economic independence through a community savings and loans system.

Established two years ago under the Kijaluba Programme, and now further strengthened through the CADiR Programme, Umoja Wetu has recorded remarkable progress beyond the expectations of many.

Most members admit that before joining the group, they had no businesses of their own. The combined effects of disability, unfavourable living conditions, and limited access to entrepreneurship education had denied them opportunities for economic self-reliance.

“Before joining Kijaluba, we had no savings and no starting point. Life was very difficult,” recalls one member.

Despite these challenges, they all shared one powerful motivation, the dream of becoming economically independent.

Through the Kijaluba Programme, members began saving small shares consistently. In 2024, after completing their savings and loan cycle, each member received returns ranging from TZS 1 million to TZS 3 million an amount they had never imagined accessing before.

During the same period, their savings exceeded the agreed share limit of TZS 1,000per share, prompting the group to establish an additional savings box to safely store the surplus. This step reflected growing motivation, financial discipline, and a deeper understanding of the importance of savings.

After accessing loans, members established various income-generating activities, including juice vending, selling food at schools, baking and selling doughnuts, fish trading, operating small retail shops, and engaging in farming activities.

One of the inspiring members is Hidaya Mohammed Ali, the Secretary of Umoja Wetu Group and a mother of a child with a disability. She shares how the group transformed her life:

“The first loan I received was TZS 900,000. It helped me start selling second-hand Abaya. That marked the official beginning of my entrepreneurship journey,” says Hidaya.

Hidaya Mohammed Ali, Secretary of the Umoja Wetu Group, pictured at her shop where she runs her business after accessing loans through the Kijaluba and CADiR programs.

Today, through loans she continues to access under Kijaluba and now CADiR, Hidaya owns a shop selling baibui, handbags, clothes, and other women’s products. She has accessed loans more than three times, enabling her to increase capital and strengthen her business.

She proudly adds:

“The SPM training empowered me greatly. Today I own a shop, I have regular customers, and I can meet my family’s needs.”

For Hidaya, the programme has not only brought financial stability but has also transformed her mentally, emotionally, and socially. She now confidently supports her child without constant financial anxiety and has gained greater respect within her community.

Other group members also testify to the real changes brought by Umoja Wetu:

“Our lives have truly changed. The money we save has helped us a lot. Even during festive seasons, we can borrow and buy clothes for our children without struggle,” they say with joy.

Members of the Umoja Wetu Group during their regular savings and loans meeting.

Despite these achievements, the group still faces some challenges, including fear among certain members of depositing and safeguarding their money in banks, which has led some to consider withdrawing from the group.

Nevertheless, the story of Umoja Wetu clearly demonstrates that persons with disabilities are not beneficiaries of charity, but full participants in development when provided with the right opportunities.

Through modest resources, continuous training, strong trust, and solidarity, Umoja Wetu has built something far more valuable than money which is hope, dignity, and the power to shape their own future.

The journey of Umoja Wetu is not an isolated success, but part of a broader movement of 38 savings and loans groups supported under the CADiR program (16 groups in Unguja and 22 in Pemba). Through the CADiR Program, the establishment and strengthening of these groups has been implemented in collaboration with Zanzibar Federation of Disabled People’s Organizations (SHIJUWAZA), and with strong partnership support from the Norwegian Association of Disabled (NAD). This partnership has played a critical role in promoting inclusive economic empowerment, strengthening financial literacy, and expanding sustainable livelihood opportunities for persons with disabilities and other marginalized community members.